Sometimes, there are huge opportunities in life and you fail to take them. These opportunities may make you regret your choices for many years to come. Sometimes you miss out… and sometimes, just sometimes, you get the chance to do it all over again.

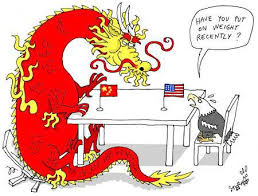

If you could invest into China 20 years ago, would you do it?

Twenty years ago, China was an economic “no-fly-zone”. Almost nobody was investing there, and those who did, were thought of as crazy. Even legendary investor Warren Buffett would not touch China; the Oracle of Omaha stayed happily investing in USA stocks for 45 years and only invested in Australia for the first time back in 2000.

Fast forward to 2007 and watch what happened when the GFC hit. The Titanic US economy dropped more than 50%, Europe and the UK dropped over 50%, and China went up by 52%…

Make a note of this — If you had invested $100k in savings or retirement funds prior to the GFC, your US investment would be less than $50k, but your Chinese stocks would be worth over $150k… quite a significant difference, don’t you think?

Three times your money back, plus a lesson for life

Yes, the so-called “emerging economies” pose some risk as well. They are not immune from corruption or scandal. But all investment carries risk, and nothing is as “safe as houses”.. The GFC proved that not even the housing market is safe from negative returns, so you could benefit from having a little diversification into areas which do not speak your language.

In 1999, we suggested investors consider an exit from over-priced USA and consider an investment into China and Australia. Within two years, the USA had a monumental melt-down (the “Tech Wreck”, followed by the 9/11 plane crash), and Aussie and Chinese markets climbed.

Back in 2005-2006 we recommended a final exit-call from the USA and investing into China and the BRIC economies. The following two years saw investment drops in the USA that are still being felt ten years later. Meanwhile, the “emerging economies” are ticking along nicely.

One plus One equals Five

As you can see above, the difference between one investment going south by 50% and one going north by 50%, is not just 50 + 50= 100% — rather than a mere doubling, the 50-up, 50-down equation creates a differential of around 300%.

Many people could have made radically greater returns, if they only knew… (and took action)

If you had heeded the warnings in “Invest News” in 1999, or if you had read “Who’s Taking Your Money? (and how to get some of it back!)” in 2006, your returns could have been dramatically better than the average investor.

“They did not listen, they did not know how… perhaps they’ll listen now…”

Even if you are not convinced by the weight of our last few predictions, you may wish to hear from some other experts. (It’s interesting to note that whilst the “poor” people are watching Reality TV shows or listening to the latest terror threats or Hollywood gossip, the truly wealthy are looking at *alternate news*, including Forbes Magazine…)

- This article in The Week states why “Africa is the new China”

- National Interest magazine calls Africa “The next big economic success story”

- Forbes magazine says that China knows what the west does not: here’s why China is putting $60 Billion into African investment

- Latest TEDx talk shows why African entrepreneurs will succeed

OK, so you may have a dozen excuses why you cannot possibly invest into Africa:

- I can’t speak the language / don’t understand the culture

- I can’t trust the truth of the economic figures / the politicians are corrupt

- what if a war breaks out / what if there is a terrorist attack

- I don’t have enough money / my super fund won’t let me do this

- and so on…

We do not wish to call *BS on your *BS excuses for why you cannot invest into Africa or other emerging economies. We just want to point out that these same *BS excuses for why (you say) you cannot invest into Africa are probably the very same *BS excuses you would have had for why (you would have said) you could not invest into China, five, ten, or twenty years ago.

Your *BS excuses are just your *Belief System*

Your *BS beliefs are not necessarily true. Unchain your mind and embrace a new possibility.

- Culture/language barrier: this never stopped anyone who invested into China, Brazil, Russia or other emerging economies. You don’t need to speak African or Chinese, you just need to know the three-letter ticker codes for the index.

- Economic disbelief: figures coming from China or Africa may seem occasionally suspect (it’s also possible that your own politicians or government lies to you about “seasonally adjusted” unemployment figures or “official” interest rates), but you cannot argue with your own returns. Chinese GDP figures of 8% YOY may be closer to 5%, but this still is 300% higher economic growth than the 1.5-2% figures from the USA, and your investment growth will be the final judge.

- Terrorist attacks or wars: violence or conflict can affect anyone, in any country, at anytime. They seem to be more common these days (due to media bias, the rate of information exchange, internet news sources etc), however, in reality, there is more peace in Africa now than there was 20 years ago.

- Not enough money/ can’t do it/ don’t know how: This is a *BS excuse and deep down, you know it. You can invest into the stockmarket index of practically any country you choose, with as little as $500 (plus around $25 for brokerage). This can be in your own name or in the name of your kids, your partner or your superannuation /retirement fund. You do NOT need to have a Self-Managed Super Fund to invest into stocks, shares, indexes (indices?) or ishares. You can do it, even if your employer says you can’t, because: 1) they can’t stop you, and 2) if you know how to do something, it doesn’t matter about the people who say it cannot be done.

Just Do It

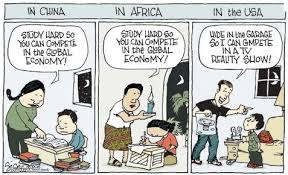

In case you have not yet noticed, immigrants, international students and others from foreign lands tend to work hard, study hard and over-achieve. This is a cultural learning because competition is often hard where they are from.

Not every African or Asian had to walk 10 miles for water, or live through famine, poverty or civil war, but many of them did. Many third-world parents faced hardships which we could only imagine, and they instil into their children a tough ethic. To get through hard times, you have to work hard and become hard. This concept permeates the culture of life, ambition and work, whether the child stays in their home country, or whether they seek opportunity in the first world.

You may not feel like working a 10-hour day job, and driving Ubers 6-10 hours each night whilst simultaneously studying for a new degree, and that is perfectly OK. If you are lazier than the average Asian or African, that’s OK. The key is this: you do not have to work 19-hour days to become wealthy, you can merely invest into those who already have the hard work ethic.

And yes, you can do it with your super fund or with $500 in spare cash. China was an amazing investment opportunity which most people missed. Africa could be the next wave, which, if you are quick, you can catch and surf all the way home.

The ishare code for investing into the Chinese index — from America is FXI, from the UK is FXC and from Australia the Chinese index trades on the Aussie stock exchange as IZZ.

For Brazil, BRIC, China, Hong Kong, Peru, Africa and other codes, plus a list of their performance, google “ishares” or contact us at www.24HourWealthCoach.com.

ETF database

**All investing carries risk, even investing into cash in the bank can be risky. No investment is guaranteed and past performance is not an indicator of future gains. We provide economic education and not investment advice. All care and no responsibility. If you disagree with this, then perhaps you should not put your money into anything other than your own back pocket.